Swipe! New Compensation Model–Tiger Trade For Agencies

What Is A “Tiger Trade” & Why Does It Matter?

Written by Mattske // September 10, 2024 (Read Time: 10 Minutes)

SUMMARY

We’ve started using a compensation model we call the “Tiger Trade,” where we get paid in publicly traded stock through platforms like CashApp instead of cash. This idea came from our frustrating experiences with equity-based compensation in startups. The Tiger Trade ties our work directly to market performance, potentially creating long-term value for both us and our clients. It also helps smaller agencies like ours build investment portfolios while aligning our interests with those of our clients. We believe this could offer a more stable and innovative alternative to traditional compensation models.

Whelp…Experiencing Growing Pains With Agency Compensation Models

When we started our company in 2014, we had been inspired by Marcus Lemonis and his show “The Profit” on CNBC. As an investor, he would do deals based solely on a handshake (at least in the context of the show) and then be “100% in charge,” which challenged the ownership of struggling companies in a big way. We also learned quickly how the startup community would often position newly founded companies as equity investing opportunities for strategic partners, including marketing companies who are perceived at having the ability to increase the valuation of the company using branding & advertising campaigns. This spoke to us, and we gave it a shot. Needless to say, it did not go very well, for a variety of reasons.

Trust & Decency Are Hard To Commoditize

New companies are incredibly volatile. They win a big project, and things look really good. They lose a big project, and things are terrible. It takes several years for any company to get off the ground, and most fail before they are even fully formed. In the half-dozen options we negotiated with respect to gaining equity in startups, none of them came to fruition. We were cheated out of some, and others simply fizzled out without fully forming. That was incredibly frustrating, because we always delivered on our promises, but couldn’t trust other people to do the same.

Just last month, Ad Age reporter Lindsay Rittenhouse published the article, “Inside Independent Agencies Driving Change In Industry Compensation Models,” where other agency owners report the exact same experience. Reading this article made me feel a lot less alone, and it also came on the heels of a new experiment I had been running which I call the “Tiger Trade.”

How A Tiger Trade Works

The premise of a Tiger Trade comes from a variety of factors, most notably the prevalence of different businesses to accept payment in the form of cryptocurrencies like Bitcoin, Ethereum, and others. While I am not a proponent of this, what I noticed is a trend in delivering an asset at a retail level, or low-cost purchase point of sale, which in my opinion is more novel than the newly minted digital & decentralized class of assets known as cryptocurrencies.

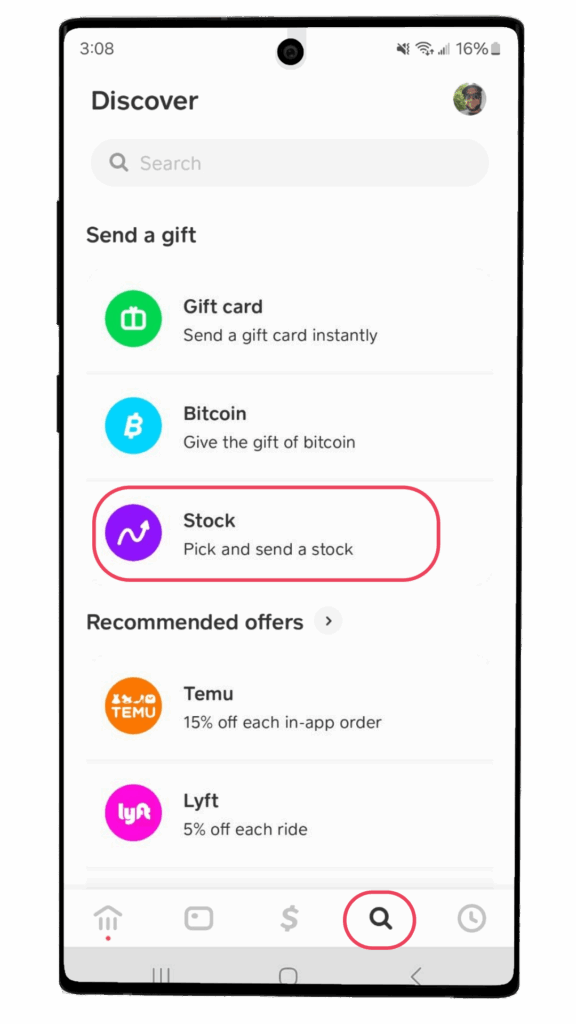

After learning that CashApp is the only (as of this writing) peer-to-peer payment processor which enables people to easily “gift” stock, I had an epiphany, that I could be compensated in the form of the publicly traded stock of any company that is available on the CashApp brokerage account. I instantly started sharing about this phenomenon and received steller agreement from people in the private banking world.

Within about (10) days, I convinced one of my startup clients to pay me for a consultation in the form of Warner Music Group ($WMG) stock, because the company this gentleman was building is in the music/tech space. The theory I had was that it would tie our conversation to something significant in the market, in an asset which could potentially increase in value compared to USD in a checking account. Another benefit of this approach is that it establishes the basis of an investment portfolio which my agency is cultivating for the retirement plan of the (2) of us who own this company regardless of whether or not we ever have other employees.

Investing In An Agency’s Future For Partners & Staff

Small agencies owned by a person or two, or only several partners, may not have access to the same kinds of investment vehicles that the majors do. That is a disadvantage, too, because in hard times when projects are lagging or payments from clients are lagging, it can be incredibly scary to figure out how to pay people or ourselves. Having stock assets in an easily liquidated portfolio like CashApp enables is a new kind of investment thesis that has a lot of people I’ve shared this with very excited. Moreover, selecting the stock to receive as compensation gives me and my clients in the startup space something to aim for or pay attention to.

For example, when a startup begins, they often don’t think about their competition or strategic partners. They can be defensive about what their idea is and how well it will work. Once a client agrees to pay me in another company’s stock (which, to my knowledge, is completely novel) – they naturally appreciate the value of that company – whether it’s as a potential competitor or partner. That is very valuable in my work as a consultant, because some founders believe they exist in some kind of competitive vacuum.

The Big Boys & Girls Club Can’t Play This Way Quite Yet

When it comes to being compensated by publicly traded companies, in the form of their own stock, it has so far proven more difficult due to internal regulatory & legal concerns about issuing stock. The strange thing is, from the perspective of the payment processor, it’s the same exact process as sending cash. Oddly enough, some of the new pitches I’ve been giving to bigger companies involve different methods of issuing stock to employees, influencers, and customers. Something has to be figured out.

CashApp currently has a limitation with respect to how their business accounts work, though, which makes them unwieldy for larger companies, in a weird way.

Project-Based Fees? Getting What You Pay For

The old model of compensation for agencies is changing, and it’s a long time coming. Lindsay Rittenhouse interviewed agencies who have tried to get equity in startups, which as I’ve described, can be a hellish ordeal. But another thing that is being discussed now is the value of an advertising or branding agency. We are routinely reduced to hourly laborers, where the cost of our service can be easily negotiated based on how long it takes to produce work. This is something that Chris Do, the founder of branding agency Futur, is famous for debunking. He has plenty of videos you can see on YouTube, where he mocks conversations between an agency and the client. Ultimately, the conclusion is that a client should value things like speed and efficacy, as well as impact, over time.

Do concludes that a client often thinks in backwards terms, where they would appreciate a longer lead time, rather than a higher hourly rate, for the same work. This is hard for small agencies to communicate to clients with micro-budgets, though, since the calculations don’t have as much wiggle room.

On the other hand, pitches at a project-based rate can be helpful to alleviate these issues. But, there is still a fear on the client’s side that they are getting ripped off, and agencies can struggle to determine how valuable their service is. I’ve often been able to negotiate for incredibly high fees, by going above & beyond to explain how my work will generate increased revenue, higher profits, or achieve some other result which is not typical of an agency of my sort.

Give Me Shelter

The Tiger Trade with publicly traded companies in terms of their own stock is a method that I believe will eventually become commonplace, because it demonstrates trust and appreciation from both the client and the agency. It says from the company’s perspective that they want the agency (or even an individual influencer) to be integral to the company for a longer term than just their contract. On the agency side, it shows a similar kind of commitment, and also if the agency believes their client is worthwhile they will go the extra mile to ensure things work – since they have an incentive to do so. It is also a much quicker method of stock transfer than a traditional bank wire which is why I call it a Tiger Trade. Bears & bulls, hawks & doves…plenty of animals are used to describe things in finance, but not really tigers.

There is a lot of room to evolve this idea.

I can understand the reticence of publicly traded companies to do this for a variety of reasons, but it also answers some of the questions which agencies and clients have about the value of one another. If I am willing to reduce my cash compensation in exchange for your stock, I’m willing to hold on to it long enough to make that worthwhile. In some way, on a big enough project, this is how agencies can demonstrate the attribution of their work. It’s hard enough to show how an ad campaign results in anything other than social media engagement. Some are able to tie their performance to things like revenue, maybe profit margins somehow. But few ad agencies (if any) are trusted with increasing the stock price.

Stock Marketing & In-Kind Payments

You could think of it like “stock market-ing,” in some sense. A revolutionary new kind of compensation model that is available to both small businesses & startups, as well as the very companies that would be exchanged like a cryptocurrency.

There are other adjacent or tangential ways this could play out, which have been speculated or mused over in the past, such as McDonalds’ rewards points being exchanged for actual USD. McDonalds needs to first figure out how to enable a person to a) keep their rewards points for as long as they want them, and b) how to use rewards points on more than (1) item at a time…but that’s another story.

Summary

In short, a Tiger Trade is the process by which any company pays another in the form of stock which is available on a peer-to-peer trading platform like CashApp. It is likely that Venmo will figure this out eventually. Webull & Robinhood will probably make it easier to do something similar as well, which would open up many more companies such as foreign businesses or others to participate in it. It’s a quick way to add value to the transaction between service providers and their clients. From the perspective of agency compensation, the main point here is that the stock market is often out of reach or mysterious, but it shouldn’t be. Fundamentals are returning in some aspects of the market, and there are a lot of undervalued companies which could serve as the kinds of currencies people were using crypto for, with more stability. For more on this, feel free to hit me up and ask questions. It’s a brand new concept I am pioneering, but soon I imagine it will be entirely commonplace.

Or at least, let’s hope so!